Key points:

- Dollar gives up some pips

- Euro on the offensive

- Fed’s rate decision uncertain

Major currency pair is looking under the weather (and under the big line) as traders rush to grab dollars amidst fading rate-cut hopes.

🔑 What’s Happening?

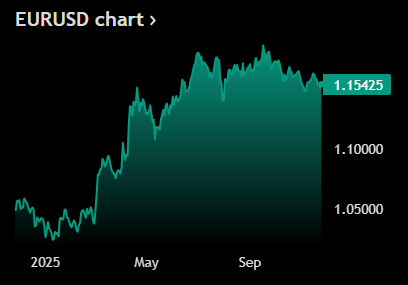

- The euro kicked off the week at a big disadvantage, having broken below its 200-day moving average last week. That’s a level closely watched by technicians as a long-term trend indicator.

- Still, the bloc’s currency managed to steal some pips from the mighty US dollar. Early Monday, the EURUSD pair hovered near $1.1530, trying to claw its way out of a multiday slump as traders were struggling to figure out the Fed’s next move.

- The recent dollar strength came after New York Fed President John Williams signaled there may still be room for “further adjustment” to interest rates.

👀 What’s the Outlook?

- The remark bolstered expectations that the Federal Reserve could deliver another quarter-point rate cut in December, despite recent uncertainty around the economic outlook.

- Futures traders quickly recalibrated: CME FedWatch now shows nearly a 70% chance of a December cut, up sharply from about 40% a week ago. That weakened the dollar because lower yields are generally bad for the local currency.

- With rate-cut bets firming and dollar appetite dropping, the euro’s dip under the 200-day line adds excitement for the week ahead.

Source: Tradingview

No responses yet