Key points:

- Gold pops early Thursday

- Traders eye data rollout

- Bullion up 60% YTD

Bullion was gaining for the seventh straight day Thursday with investors getting optimistic about the release of economic data.

🤑 Shutdown’s End Fuels Market Optimism

- Gold prices XAUUSD rose for the seventh straight session Thursday, climbing above $4,200 per ounce to reach their highest level in more than three weeks.

- The rally came as investors cheered the end of the longest government shutdown in US history, which they expect will restart key economic data releases and reinforce expectations of further interest rate cuts.

- President Donald Trump signed legislation late Wednesday officially reopening the federal government after a 43-day shutdown that froze the release of major economic data, including nonfarm payrolls and CPI inflation reports.

📞 Rate-Cut Bets Keep Bullion Shining

- Economists expect the US Labor Department to prioritize November’s employment and inflation reports, allowing the Federal Reserve to better assess the economy’s health before its December policy meeting.

- With the data blackout ending, traders are positioning for a potential round of weak numbers – an outcome that could strengthen the case for another rate cut next month.

- According to a Reuters poll, 80% of economists now expect the Fed to cut rates by 25 basis points in December, up slightly from last month’s survey.

🗓️ Year of the Gold Bulls

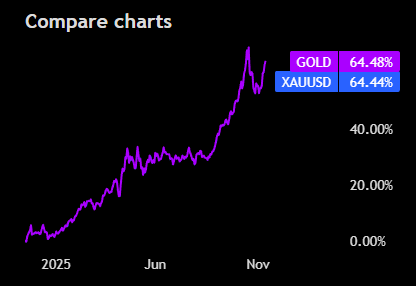

- Gold is up roughly 60% year-to-date, making it one of the best-performing major assets of 2025.

- Prices hit an all-time high near $4,400 in mid-October, supported by persistent geopolitical tensions, trade uncertainties, and Fed dovishness.

- The metal’s resilience has kept it front and center for investors seeking shelter from macro risks, even as stocks hit record highs and crypto markets remain volatile.

Source: Tradingview

No responses yet