Key points:

- Gold on the move early Monday

- Global sentiment favors the metal

- Markets eye next rate cut by the Fed

Mix of news for gold bugs propelled the precious metal early morning. What’s in the mix? Rate cut bets, gloomy outlook, worrying jobs data.

📈 Rate-Cut Bets Fuel the Rally

- Gold prices XAUUSD surged over 2% early Monday, topping $4,080 per ounce, as traders ramped up bets that the Federal Reserve will cut interest rates in December despite recent pushback from policymakers.

- The CME FedWatch Tool now shows a 67% probability of a rate cut next month, up sharply from last week’s 50%. Lower interest rates make non-yielding assets like gold more attractive by reducing the opportunity cost of holding them.

- The renewed optimism comes after the US Senate appeared close to ending the 40-day government shutdown, potentially restoring some clarity to an economic picture that’s been distorted by missing data releases.

🪙 Weak Data Strengthens Gold’s Case

- October jobs data showed net losses, especially across government and retail sectors, signaling a cooling labor market.

- Meanwhile, a University of Michigan survey revealed that consumer sentiment has fallen to its lowest level in three and a half years, lower by 30% from last year.

- The combination of economic weakness and political gridlock has investors rotating into safe-haven assets — gold being the prime beneficiary.

🏆 Market Sentiment Turns Gold-Friendly

- The market’s narrative has shifted largely toward defensive positioning. Traders are reassessing the strength of the post-AI equity rally, and gold is once again proving its worth as a hedge against both inflation and policy uncertainty.

- The global slowdown story is also gaining traction, with weaker manufacturing readings across Europe and Asia adding to the case for lower rates.

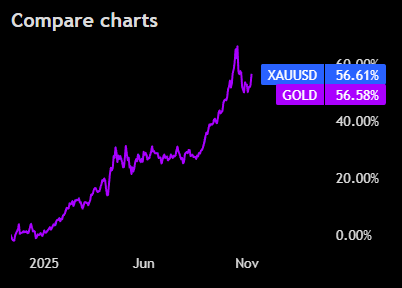

- In this environment, gold’s twin appeal — safety and speculation — is hard to ignore, especially as the metal has already climbed more than 50% year to date and remains within striking distance of its record high near $4,400.

No responses yet