Key points:

- Nasdaq futures climb Monday morning

- Big tech earnings ramp up this week

- Inflation expected to stay elevated

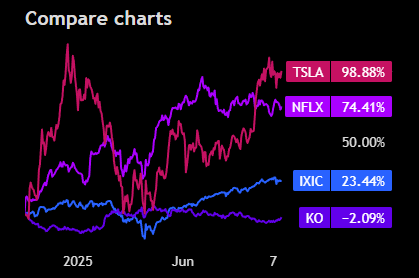

It’s a week for the geeks and the binge-watchers with Netflix, Tesla, and Intel reporting this week.

🚀 Futures Rise Ahead of a Packed Week

- Futures contracts tied to the Nasdaq Composite IXIC jumped 0.5% Sunday night, with S&P 500 futures up 0.4% and Dow Jones futures higher by 0.3%, setting a positive tone ahead of what’s shaping up to be one of the busiest weeks of the earnings season.

- The optimism follows a volatile week that saw traders swing between tariff headlines, regional bank jitters, and profit-taking in the red-hot AI trade. Despite the noise, the major indexes closed higher, helped by better-than-expected financial results from Wall Street’s biggest banks.

- With sentiment improving and hopes of a Fed rate cut later this month, investors are bracing for what could be a defining stretch for both earnings momentum and inflation expectations.

📺 Earnings Spotlight

- This week, it’s tech’s turn to deliver. Netflix NFLX will lead the charge Tuesday, with investors looking for subscriber growth amid content spending discipline. Coca-Cola KO also reports the same day, giving a read on consumer strength.

- On Wednesday, all eyes will be on Tesla TSLA, which is coming off a record quarter for deliveries but faces questions about its new lower-cost models and thinner margins.

- Intel INTC, reporting Thursday, closes the tech-heavy lineup, with analysts watching for signs of recovery in the PC and data center businesses — both under pressure from AI-driven competitors like Nvidia NVDA and AMD AMD.

📊 Inflation and the Shutdown Shadow

- The September CPI report hits Friday and is expected to show inflation remains stubbornly hot, particularly in services. Economists anticipate the headline figure to hover around 3.1% year-over-year, keeping the Fed’s October 28–29 meeting firmly in traders’ crosshairs.

- The ongoing government shutdown means economic visibility is still murky — much of the usual labor and spending data hasn’t been released for three weeks. That makes the CPI print even more important as one of the few hard data points left standing.

- Fed officials have signaled that another 25-basis-point cut is likely if inflation cools just enough to give policymakers room — and markets seem to be pricing that in with growing confidence.

Source: Tradingview

No responses yet