Key points:

- Gold is on a tear

- Prices rip to $4,380

- Silver is even better

Massive pump has taken bullion to the stratosphere. The precious metal is having its best year since your dad was jamming out to that just-released track “Another Brick in the Wall.”

🚀 Gold Rockets to New High

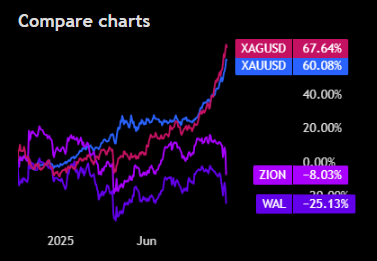

- Party like it’s 1979? You bet. And all the gold bugs out there bet on that, too. Gold XAUUSD is charting its best year since Pink Floyd released “Another Brick in the Wall.” Yes, that’s 46 years ago.

- Bullion this morning smashed through $4,380, up 65% on the year so far, its most-glamorous year since a 136% increase in 1979.

- The rally is red-hot, fiery, and no one dares to bet against it. This week alone, gold is up a massive 8%, and is set to close out the ninth straight winning week, a powerful stretch that has added 33% to the metal’s valuation.

🎛️ Powerful Mix of Factors

- What’s behind the pump? Nothing unusual about it. It’s the same old cocktail of geopolitical uncertainty, trade war troubles, weak labor market and elevated prospects of interest rate cuts.

- One thing that may be adding some fresh fuel to the rally is that regional banks in the US are likely doing some shady stuff.

- Two of them, Zions Bancorp ZION and Western Alliance WAL, triggered a stock selloff on Thursday after word got out they’re under pressure from ill-fated lending.

📼 How High Is Too High?

- How high can gold go from here? As the saying goes, sky is the limit. Gold’s powerful rally is supported by heavy buying from central banks, ETFs, funds, retail traders, and ordinary consumers who want to pivot away from the dollar and park their cash to wait out the storms.

- A look at technicals shows that the RSI is above 86, it’s highest since, you guessed it, your dad was blasting cassette tapes in ‘79.

- Silver XAGUSD is also breaking moves and shooting to record highs. The metal, also in its ninth week of winning, is up 85% this year and charting new horizons above $53.

Source: Tradingview

No responses yet