Key points:

- Gold pops to fresh all-time high

- Silver joins the record run

- Tariffs and rate cut drive demand

Institutions, retail traders, consumers, central banks — you name it, they’re all buying gold amid continuing uncertainty around the globe.

🏆 Safe-Haven Rush Sends Gold to New Heights

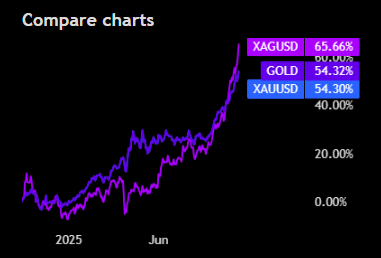

- Gold prices XAUUSD rocketed through $4,080 per ounce on Monday, setting yet another record as investors around the world piled into the storied safe-have asset. Silver XAGUSD followed suit, hitting an all-time high of its own. Prices soared above 51.50 earlier today.

- The rally comes as renewed US-China trade tensions jolt markets and investors position for more Federal Reserve rate cuts. Tariff headlines, political chaos, and a government shutdown have made gold’s case louder than ever.

- Year-to-date, gold has gained a jaw-dropping 54%, fueled by central bank buying, ETF inflows, and mounting economic uncertainty. Add to that retail traders and ordinary consumers and you’ve got everyone buying one shiny thing.

💬 Trump’s Trade Drama Adds Fuel

- On Friday, President Donald Trump slapped 100% tariffs on Chinese imports and unveiled export controls on key software, effective November 1. Beijing said it will introduce “countermeasures,” adding that it was “not afraid” of a trade war.

- By Sunday night, Trump tried to calm the waters with his now-familiar reversal: “Don’t worry about China, it will all be fine!” he posted, adding that President Xi “just had a bad moment.”

- Still, gold bugs refuse to let go and take their profits. Every tariff threat or reversal only amplifies demand for gold, as traders hedge against Trump’s unpredictable trade diplomacy — and the potential economic fallout.

💰 Fed Cut Hopes Keep Bulls in Control

- Traders are betting heavily that the Federal Reserve will cut rates again in October and December, each by 25 basis points, as the central bank tries to manage slower growth and shaky confidence. Lower rates make non-yielding gold more attractive.

- The Fed’s next big cue is coming Tuesday from Chair Jay Powell’s speech at the National Association for Business Economic (NABE). Expect volatility across all assets, not just the precious metal.

- The ongoing US government shutdown, which has delayed key economic data, keeps adding to the uncertainty with every passing day. With no hard numbers to guide markets, now 13 days in, the safe-haven trade looks like a good place to wait for the daylight to hit again.

Source: Tradingview

No responses yet