Key points:

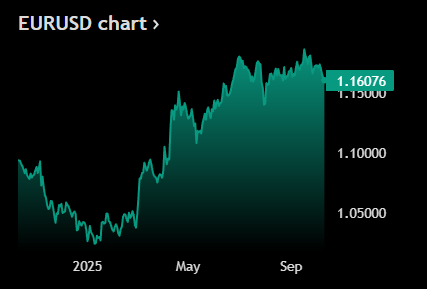

- Euro slips toward $1.16

- Fed minutes show split

- US shutdown continues

Is it just one by the end of the year? Or two? The Fed squad is split over how many trims to interest rates they should carry out.

💵 Dollar Finds Its Mojo

- The EURUSD slipped to $1.16 on Thursday, on track for its fourth consecutive daily loss as traders digested the latest Federal Reserve minutes. And it’s showing policymakers split on how fast and how far to cut interest rates this year.

- The minutes revealed a nearly unanimous agreement that a rate cut was needed in September amid clear labor market weakness, but officials disagreed over whether there should be two or three total cuts for 2025.

- That uncertainty gave the US dollar an unexpected tailwind, as traders bet that a cautious Fed could keep rates elevated longer than markets initially hoped. And yes, the greenback is pumping while Washington remains closed for business.

🏆 Fed Split in Two Camps

- According to the meeting summary, a 10–9 majority of voting members favors quarter-point cuts at each of the two remaining Fed meetings this year. So it’s not a done deal as there could be only one trim if one official switches sides.

- Projection materials also hinted at the possibility of one more cut in both 2026 and 2027, before settling near a long-term funds rate of around 3%. In other words, the rapid policy unwinding is about to grind to a halt pretty soon.

- As one analyst put it: “The Fed’s stuck between fighting inflation with rate holds and fighting recession fears with rate cuts.” Translation? There’s no perfect move, and the markets hate indecision.

🧨 Data Silence and Dollar Power

- The US government shutdown continues, meaning no jobless claims today and no nonfarm payrolls tomorrow. It’s a rare economic blackout that leaves traders flying in the dark and trading on hopes things are still bright.

- Despite the data drought, investors are still favoring the greenback, seeing it as an odd safe haven amid internal uncertainty about both US fiscal stability and the Fed’s next steps.

- With the euro losing altitude and US yields holding firm, the balance of power remains tilted toward the dollar. That is, at least until Capitol Hill flips the switch back on.

Source: Tradingview

No responses yet