Key points:

- Dollar outlook uncertain

- US data gets spotty

- Shutdown throws shade

Greenback bulls aren’t sure how to approach the situation – the US government is in shutdown and the private payrolls shed 32,000 jobs instead of a 50,000 gain. Is the NFP even coming Friday?

🛠️ Dollar Trips, Euro Climbs

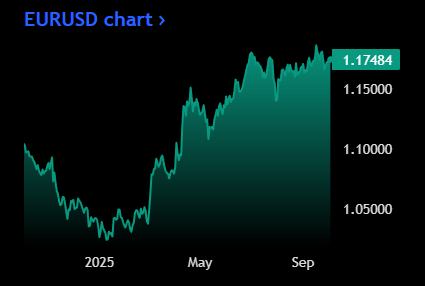

- The EURUSD pair popped above $1.1750 Thursday after the US dollar erased early-session gains. Currency traders are juggling a confusing mix: government shutdown, missing jobs data, and a surprise drop in ADP payrolls.

- Shutdown chaos means Friday’s NFP report may never see the light of day. If that happens, traders lose the single most important jobs benchmark heading into the Fed’s late-October meeting.

- Without clarity, the greenback loses some of its shine. The euro’s taking advantage, posting gains for the fourth day in the last five despite mixed global sentiment.

📝 ADP Adds Fuel to the Fire

- Private-sector jobs fell by 32,000 in September, according to ADP. Economists had expected a gain of 50,000. Another signal that Trump’s tariffs are hurting business sentiment and hiring efforts due to the elevated uncertainty going forward.

- With government agencies offline, the ADP report may be one of the few windows into US employment this month. But technical quirks mean investors won’t take it as gospel.

- Still, a negative print adds to the narrative of a cooling labor market. That could tip the balance toward more aggressive Fed cuts. But without official NFP confirmation, it’s all just guesswork.

☁️ Dollar Outlook Gets Murkier

- Normally, weak jobs data equals a weaker dollar, since it supports Fed easing. But this time, it’s complicated: no NFP (potentially) means traders are flying in the dark into October’s Fed meeting.

- Markets are already pricing in at least a quarter-point cut by end of year. But if policymakers don’t get fresh labor data, they may hesitate to move too aggressively. That uncertainty keeps the dollar from tanking.

- Where are we right now? The euro is feasting on dollar confusion, but the real driver ahead will be whether Washington can switch the lights back on before key data goes missing.

Source: Tradingview

No responses yet