Key points:

- Bitcoin slides to fresh 8-month low

- Jobs data dents rate-cut hopes

- Broader crypto market sinks

Steep selloff showed no signs of stopping. The leading crypto asset is now lower by 35% from its record high.

✨ Crypto Selloff Accelerates

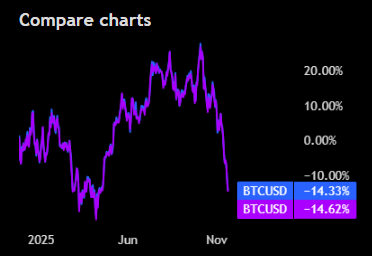

- Bitcoin BTCUSD fell under $82,000 early Friday, marking its lowest level since April and extending its decline to 35% below its all-time high.

- What began as a controlled pullback, with crypto bros saying it’s only a mere dip, has now morphed into a full-blown de-risking wave across the digital asset market.

- The late-arriving September employment report, delayed because of the government shutdown, showed the economy added 119,000 new jobs. This was a big surprise after much talk of weakness.

📢 Pain Across the Crypto Board

- Instead of clarifying the Federal Reserve’s path, the data complicated it. A firmer labor market could weaken the argument for another rate cut at the December meeting

- Higher-for-longer rates typically sap demand for speculative assets. Naturally, Bitcoin took the hit first. But it wasn’t the only one getting hurt.

- Ether plunged below $2,700, now lower by more than 46% from its near-$5,000 record. Solana dropped to $130, extending its multi-week slide. Total crypto market value sank further after this week’s liquidation-driven rout.

Source: Tradingview

No responses yet