Key points:

- UK inflation cools to 3.6% in October

- Traders ramp up bets for a December rate cut

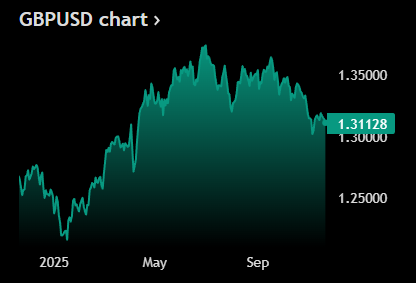

- Pound holds steady near $1.3140 despite softer data

Rate cut bets just got more real as consumer prices slipped from the month prior. What’s the UK currency going to do now?

🔑 Inflation Cools, Rate Cut Odds Heat Up

- The GBPUSD barely budged on Wednesday, even after UK inflation slipped on a monthly basis.

- The UK reported consumer prices grew 3.6% for October, a slide from 3.8% in September and broadly in line with expectations from economists surveyed by Reuters.

- The cooloff was fueled by smaller rises in gas and electricity bills compared with a year ago, plus easing hotel prices.

🌅 Pound Holds Flat Despite Softer CPI

- Traders wasted no time adjusting: market pricing for a December quarter-point cut jumped to 85%, up from 80% earlier in the week.

- Sterling traded around $1.3140 early Wednesday, sticking to the narrow band that has capped its moves for the past week.

- Typically, softer inflation would weigh more heavily on a currency. But the cable held steady as the figure was widely anticipated, meeting analysts’ consensus calls.

👀 What’s Next for Cable?

- It could also be that the market had already priced in much of the Bank of England’s dovish shift, limiting fresh downside for the pound.

- The BoE kept rates at 4% in a closely split vote, but policymakers made clear a December cut was possible if price pressures continued to ease.

- Focus now shifts across the water. The US is ready to dump its delayed jobs data for September. Brace for volatility Thursday.

Source: Tradingview

No responses yet