Key points:

- SoftBank dumps Nvidia stake

- OpenAI funding as a priority

- Payout is tiny compared to 2016 bet

Japan’s corporate risk taker said in its earnings report that all 32.1 million shares of Nvidia were unloaded in October.

💸 The Great Portfolio Pivot

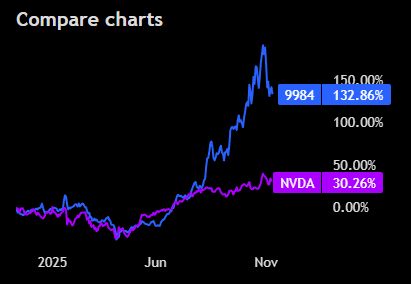

- SoftBank 9984 confirmed Tuesday it sold all 32.1 million Nvidia shares NVDA in October. Coincidentally, the same month the US chipmaker became the first company to top $5 trillion in market value.

- The move comes as SoftBank doubles down on AI infrastructure and startups, notably OpenAI, where it has already funneled $7.5 billion this year and plans to invest a total of $30 billion.

- Despite timing the exit near Nvidia’s highs, investors viewed the sale as a shift away from the booming AI-chip trade, triggering the 10% stock drop in Tokyo trading. Nvidia shares fell nearly 3%.

🤖 Betting the House on OpenAI

- SoftBank’s OpenAI investment has already started paying off. The tech investor said quarterly profit more than doubled year-over-year to $16.2 billion, boosted by paper gains in its OpenAI holdings.

- OpenAI’s private valuation recently hit $500 billion, making it the world’s most valuable private company, and a cornerstone of SoftBank’s new AI-first vision.

📉 Déjà Vu of Missed Fortunes

- SoftBank’s Nvidia trade is déjà vu for longtime market watchers. The firm had owned 5% of Nvidia back in 2016, only to sell it in 2019—missing out on a $210 billion windfall had it held through today.

- The latest Nvidia position, acquired gradually since 2020, was a far smaller stake of 0.13%—but still yielded a massive $5.8 billion return from an initial investment of roughly $180 million.

Source: Tradingview

No responses yet