Key points:

- Netflix with the 10-for-1 move

- Shares rise pre-market Friday

- Does it matter to traders?

“Retail traders, this one’s for you.” Netflix, probably, as its board decided to split a share into ten and make the stock more accessible (but not more affordable).

🎬 More Shares, Same Value

- Netflix NFLX announced a 10-for-1 stock split Thursday, joining a growing list of mega-cap tech firms that have turned to splits to make their sky-high share prices look more approachable.

- Existing shareholders as of Nov. 10 will receive nine additional shares for each one they already own. The new shares will be distributed on Nov. 14, and the stock will begin trading at its split-adjusted price on Monday, Nov. 17.

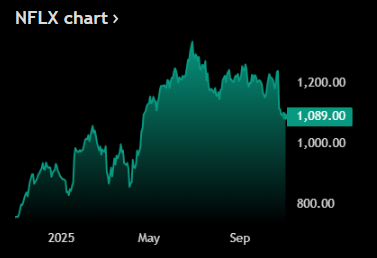

- Shares climbed 2% in pre-market Friday, after closing at $1,089, up 42% year to date — and making Netflix one of only 10 S&P 500 stocks priced above four digits.

💡 Why It Matters

- A stock split doesn’t change Netflix’s market value or fundamentals. Instead, it simply increases the number of shares while proportionally reducing their price.

- But perception matters: a lower nominal share price tends to boost liquidity, attract retail traders, and help employees participating in stock option programs.

- The company explicitly said it aims to “reset the market price… to a range that will be more accessible”

- At over $1,000 per share, Netflix had become a tough ticket for smaller investors — and a split could reignite retail enthusiasm just in time for what’s shaping up to be a robust holiday content slate.

- It’s the company’s third stock split ever, following a 7-for-1 split in 2015 and a 2-for-1 split in 2004.

Source: Tradingview

No responses yet