Key points:

- Google shares soar 8%

- Company posts easy win

- Guidance gets a lift (yes, AI)

Great quarter for the search dominator — an easy beat on both earnings and revenue, plus raised guidance that didn’t knock confidence.

🚀 Blowout Quarter, Record Revenue

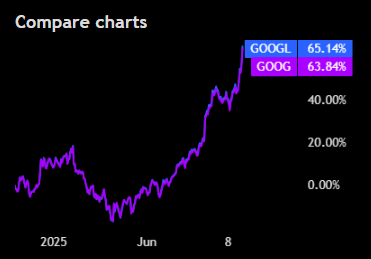

- Alphabet stock GOOGL surged 8% in premarket trading Thursday after the Google parent posted third-quarter results that crushed expectations on both the top and bottom lines.

- Earnings per share came in at $2.87, well above Wall Street’s $2.26 estimate and up from $2.12 a year ago.

- Revenue soared to $102.3 billion, marking the first time in company history that Alphabet crossed the $100 billion mark in a single quarter. It’s a 16% year-over-year increase that easily topped projections of $99.9 billion.

💰 Margins Tighten, but Still Healthy

- Alphabet’s operating margin landed at 30.5%, a touch below estimates and down from 32.3% last year.

- Excluding a $3.5 billion European Commission fine, however, the adjusted margin would have been 33.9%, showing that profitability remains robust despite heavy spending on AI infrastructure.

- Analysts largely brushed off the fine, noting that Alphabet’s core businesses — search, YouTube, and cloud — are firing on all cylinders.

☁️ Cloud Soars, AI Spending Climbs

- Alphabet said it’s raising its 2025 AI data center budget for its Google Cloud unit to $92 billion, up from the prior $85 billion estimate — a clear sign it’s doubling down on the AI boom.

- Cloud sales jumped 34% year over year, continuing to outpace broader company growth.

- Even better, the unit’s operating margin improved to 24% from 17% last year. Finally, scale and smarter cost management are paying off.

Source: Tradingview

No responses yet