Key points:

- Pound heads lower for 6th day

- UK retail sales rise 0.5%

- Traders await Fed decision

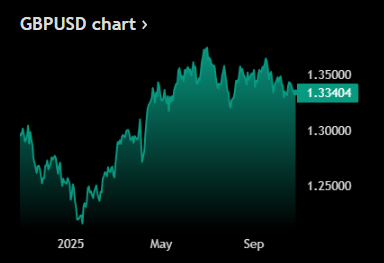

UK currency is on track for its sixth straight decline against the dollar with the cable pressing toward $1.33 early Friday.

🛍️ Retail Sales Defy Consensus

- The GBPUSD pair slipped toward $1.33 early Friday, on track for its sixth straight daily decline as traders piled back into the dollar.

- The greenback’s strength is being fueled by expectations the Federal Reserve will cut rates cautiously, while the Bank of England faces growing doubts over how much room it has to ease policy without reigniting inflation.

- UK retail sales rose 0.5% in September, marking the fourth straight month of growth, according to data released earlier today.

🔍 Data Tops Expectations

- Economists had penciled in a 0.2% decline, so the data came as a pleasant surprise — and a sign that consumers are still spending despite inflation’s grip.

- The August figure was also revised higher to 0.6% from 0.5%, adding to evidence of steady momentum heading into what’s expected to be a difficult Budget month in November.

💷 Resilient Consumers, Stubborn Inflation

- Consumer prices rose 3.8% in September, nearly double the Bank of England’s 2% target, keeping policymakers in a tough spot.

- A tight squeeze between slowing wage growth and persistent price pressures continues to weigh on household finances — but for now, shoppers are hanging in there.

- In other words, good UK data might delay rate cuts — but not enough to give the pound too much of a lift.

No responses yet