Key points:

- Yen tumbles on Takaichi win

- Cheaper currency for easier funding?

- Finance minister to play a key role

What’s the yen supposed to do now when pro-stimulus Takaichi might want a cheaper currency to back her loose monetary policy?

💥 Dollar Flexes as Yen Slides

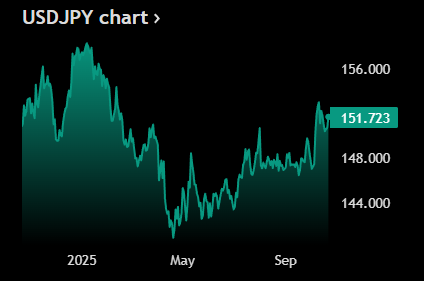

- The USDJPY pair surged to ¥151.60 on Tuesday — up 0.8% intraday — before easing back to hover near ¥151.00 as traders priced in expectations of looser monetary policy under Japan’s incoming leadership.

- The move came after Sanae Takaichi won Japan’s parliamentary vote, becoming the nation’s first female prime minister and signaling a likely continuation of pro-growth, pro-stimulus economic policies.

- The yen’s decline highlights renewed market bets that interest rates will stay lower for longer, potentially widening the yield gap between Japan and the US and keeping the dollar well-bid.

👩🏻💼 Japan’s First Female PM

- A staunch conservative and long-time ally of the late Shinzo Abe, Takaichi has been widely viewed as a champion of Abenomics — the three-arrow policy mix of monetary easing, fiscal stimulus, and structural reform designed to revive Japan’s growth.

- Just last year, she criticized the Bank of Japan’s moves to raise rates, arguing that premature tightening could choke off Japan’s fragile recovery.

- That stance suggests Takaichi will likely support continued stimulus — even at the cost of a weaker yen — as she pushes for stronger domestic demand and industrial competitiveness.

💴 Katayama as Key Policy Anchor

- The new prime minister is expected to tap Satsuki Katayama for finance minister. A fiscal conservative but policy pragmatist, Katayama may seek a balance between yen stability and aggressive government spending.

- Markets believe her presence could temper extreme currency moves, but also help unlock easier funding for Takaichi’s expansive stimulus agenda.

- Despite the political shift, BOJ Governor Kazuo Ueda has reiterated that the central bank will set rates ‘without preconceptions,’ hinting that policy decisions won’t necessarily echo Takaichi’s preferences.

Source: Tradingview

No responses yet