Key points:

- Salesforce shares rise on guidance

- $60 billion revenue forecast in 2030

- Dreamforce conference wraps up

You know how interviewers love to ask the 5-year plan question. Salesforce just answered it without anybody asking.

📈 Dreamforce Vision:

- Salesforce CRM shares jumped 5% in after-hours trading Wednesday after the company unveiled an ambitious new five-year plan. Sights are set and the target is $60 billion in revenue by 2030 — above Wall Street’s consensus estimate of $58.4 billion.

- Speaking at the company’s Dreamforce conference in San Francisco, CFO Robin Washington said Salesforce’s growth slowdown is reversing course: “We’ve had some lower-stage growth for a while — that is reaccelerating.”

- The company is betting on organic revenue growth above 10% annually from fiscal 2026 through 2030, marking a return to double-digit expansion after dipping below that pace in mid-2024.

🤖 The AI Ace Up Salesforce’s Sleeve

- Salesforce’s growth engine for the next decade appears to be Agentforce, its AI-powered platform for automating customer service and business workflows.

- The software connects large language models (LLMs) to company data, allowing organizations to build chat-based customer support agents that can handle complex interactions.

- FedEx, Pandora, and Pepsi are among the early adopters — and Salesforce executives hinted that Agentforce could become a multibillion-dollar product line as enterprises double down on AI-driven automation.

💸 Going from 38 to 60

- Salesforce posted $38 billion in revenue in its last fiscal year, meaning it plans to grow by more than 50% in five years. Steep.

- That’s a tall order given that growth slipped below 10% in 2024 as enterprise spending slowed. But management says the company’s renewed focus on organic expansion and AI adoption gives it a clear path forward.

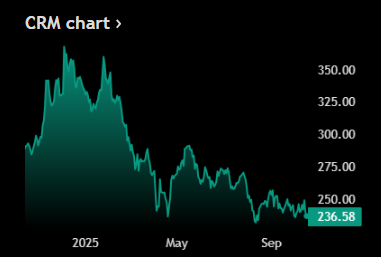

- Investors seem to agree — or at least buy the news. The 5% stock pop is coming after a brutal year-to-date performance, showing a 29% drop. The software giant has largely missed the AI train while big tech is rallying hard on froth, hype, and noise.

Source: Tradingview

No responses yet