Key points:

- Dollar makes moves in FX

- Traders price in trade cooldown

- Fed expectations get reshuffled

Fresh wave of buying enthusiasm is lifting the dollar higher amid receding trade war jitters, Fed expectations, and the ongoing government shutdown.

🦁 Dollar Comes Roaring Back

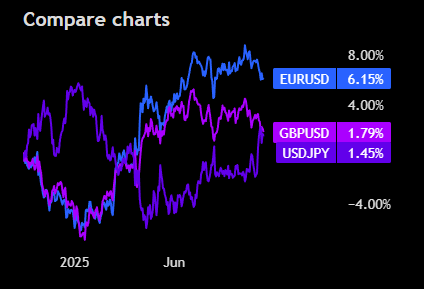

- The US dollar flexed its muscles across global FX markets Tuesday, pushing the EURUSD pair below $1.1550 and notching gains against most major peers. The greenback is ticking higher for a second straight session as risk appetite returns.

- The shift came after Donald Trump softened his trade rhetoric toward China, reassuring markets that his 100% tariff threats may not turn into a full-blown trade war. “Don’t worry about China, it will all be fine!” the President said in a Sunday post.

- Treasury Secretary Scott Bessent confirmed Trump is still expected to meet President Xi in South Korea later this month — another reason for traders to unwind some of their risk aversion and reposition for a stronger greenback.

📊 Fed Expectations Fuel Dollar Demand

- Traders are also reassessing their bets on aggressive Federal Reserve rate cuts. The market now expects a more gradual easing path, given that recent trade tensions appear to be cooling and inflation remains sticky.

- A less dovish Fed typically supports the dollar, since higher interest rates attract global capital seeking handsome yields. Even amid the ongoing government shutdown, traders are betting Jay Powell and his central-bank squad won’t feel pressured to move too quickly.

- The euro has now lost roughly 80 pips since the start of the week in a show of sentiment tilting toward the greenback — even as the broader economic backdrop remains murky.

🌍 Global Currencies Under Pressure

- The GBPUSD slid to $1.3250, down from a session high near $1.3350, as traders stayed cautious ahead of key UK economic reports later in the week (GDP data out Thursday).

- In Asia, the yen was mostly unchanged, with USDJPY hovering near ¥152, after pro-stimulus candidate Sanae Takaichi’s rise to Japan’s premiership dampened expectations for future rate hikes by the Bank of Japan.

- With the US government now in its 14th day of shutdown, and economic data releases frozen, investors are flying in the dark. Apparently, the dollar is acting as their guiding light.

Source: Tradingview

No responses yet