Key points:

- Euro turns lower Thursday

- Markets price in dollar strength

- Powell’s comments rejigger FX deals

Interest rate expectations are reshuffling forex markets with the US dollar pressing higher across the board.

💵 Euro Slips as Dollar Gets Its Mojo Back

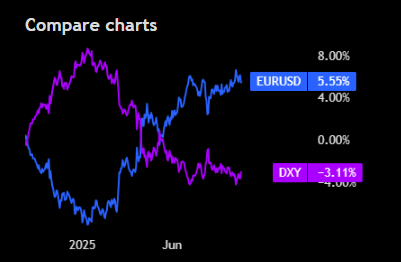

- The EURUSD dropped to $1.1720 early Thursday, extending Wednesday’s slide from a peak of $1.1820. That’s a clean 100-pip move in two sessions, as traders ditched the euro for the greenback. Resistance at $1.18 now feels like a mile away.

- The US dollar index DXY popped 0.6% to 97.86, its highest in nearly two weeks. Broad dollar strength is flexing across forex markets, fueled by Powell’s comments on inflation and labor market risks.

- Higher US Treasury yields are adding to the dollar’s tailwind. Traders are recalibrating their rate-cut bets, and every tweak in expectations shows up immediately in the FX charts.

🎤 Powell Plays It Hawkish

- Powell’s Tuesday remarks gave traders plenty to chew on. Inflation? Rising. Labor market? Weakening. Policy? Data-dependent. Buckle up, there’s no preset path, and volatility is the new baseline.

- The Fed chief’s narrative now is about there being “no risk-free path.” It underscored the tightrope the Fed’s walking – cut too much and inflation roars, cut too little and jobs get crunched.

- He didn’t confirm or deny anything about October or December. That ambiguity left markets reading his tone as moderately hawkish, lifting the dollar on expectations the Fed may tread more carefully.

📉 Rate Cut Odds in Question

- Interest-rate futures still see cuts in October and December, but enthusiasm for deep cuts into 2026 is fading. That shift alone is enough to goose the dollar and cool down euro bulls.

- Traders are trimming bets on multiple follow-on cuts next year. A “one and done” scenario for late 2025 is creeping into the playbook, which could tighten the runway for dollar bears.

- Presently, the market’s balancing act is clear: a dollar that’s climbing, a euro that’s losing altitude, and Powell’s words acting as the only compass for the road ahead.

Source: Tradingview

No responses yet