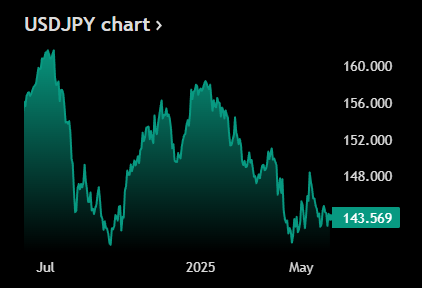

USD/JPY: Dollar Reclaims ¥144.00 as Yen Traders Pull Back After Ueda’s Rate Message Rings Hollow

Key points:

- Yen retreats, dollar rises

- Ueda fails to excite yen traders

- Complicated economic picture in Japan

Borrowing costs will rise only if Japan’s economy shows it’s strong enough to keep growing in a high-rate environment, Ueda said to parliament.

💪 Dollar Fights Back: Yen Rally Fizzles

- The USDJPY pair bounced back above ¥144.00 on Wednesday as traders dialed down their hawkish expectations for Japan’s monetary policy.

- After a multi-day yen rally during the back half of May, the dollar regained ground following cautious comments from Bank of Japan Governor Kazuo Ueda on Wednesday. Rate hikes will only come when Japan’s economy proves strong enough to sustain them, Ueda said.

- The Governor’s measured tone signaled no urgency to act, leaving yen bulls disappointed — and setting the stage for the greenback to reclaim short-term dominance. High rates typically benefit the local currency as deposit yields rise and foreign capital flows in.

🤔 Ueda Tries to Thread the Needle

- In testimony to parliament, Ueda said the BOJ will stay on course with bond tapering beyond March but will not rush into rate hikes until wage and price growth show sustainable momentum.

- He acknowledged that US tariffs could pressure Japanese company bonuses and wage talks, potentially dampening future consumer demand.

- Despite headline inflation running hot at 4.6% in April, Ueda remains confident that food price pressures will ease and consumption will stay resilient.

🌀 Japan’s Balancing Act — Inflation & Growth

- Rising import costs and a surge in rice prices have fueled inflation, complicating the central bank’s policy path. The BOJ is in a tough spot: inflation is well above target, yet domestic demand is still fragile.

- Ueda emphasized that the BOJ expects both economic and wage growth to re-accelerate, which would eventually justify higher rates.

- Until then, however, Japan’s rate differential with the US remains intact — a key driver of dollar-yen direction and a continued headwind for the yen.

Source: Tradingview

No responses yet