EUR/USD: Euro Grabs Pips Against Dollar as Jam-Packed Week Seeks to Rattle Forex Markets

Key points:

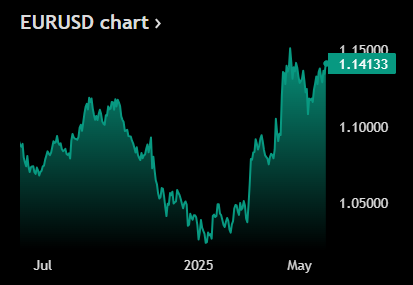

- Euro rides five months of gains

- EU currency perks up above $1.14

- Key data to follow this week

Bloc’s currency was making progress early Monday, looking to break out above the mid-term resistance. It’s almost there.

🏎️ Euro Takes Early Lead

- The EURUSD pair nudged higher in early Monday trading, reaching for the $1.14 handle as traders leaned into the euro’s momentum. This comes after a volatile May and some relative cooling in US dollar strength.

- Technical traders have their eyes locked on $1.14 — a key resistance level that’s capped upward movement since April. A breakout above could mark a fresh bullish phase and bring about some angry bears.

- With dollar sentiment on edge after Trump’s tariff U-turns, the euro is finding buyers eager to ride the macro noise into opportunity. That said, the euro just secured its fifth straight month of gains against the greenback.

📢 Data-Heavy Week Incoming

- Markets are bracing for a flurry of US data — ISM manufacturing, jobless claims, and Friday’s big-ticket item: non-farm payrolls. All could send the dollar flying or flailing.

- Any signs of softening US labor market figures or a miss on inflation expectations might fuel euro bulls and drag the dollar lower.

- On the European side, calm around ECB policy — an expected rate cut is on the table for Thursday — and steady inflation numbers (eurozone CPI data coming Tuesday) are creating a quietly confident tone for the single currency to move higher.

🤝 Trade Tensions Take a Backseat

- With Trump’s tariff threat on the EU now delayed to July 9, relief has rippled through forex desks. The euro is basking in that calm.

- Eurozone exporters are breathing easier, at least for now, reducing some of the downside pressure on the bloc’s economy and currency.

- Traders now see even more space for the euro to pump up after being utterly successful in the first half of the year — if this calm holds and incoming data favors the euro, the FX crowd could press further into long positions.

Source: Tradingview

No responses yet